Indices trading

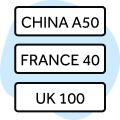

Trade major global indices with an award-winning provider*. Our spreads start from:

- 1 point for Germany 30

- 0.9 points for France 40

- 5 points for Spain 35

Why trade indices with OANDA?

Go long or short on 15 major global indices

Instant execution - no dealer intervention

Trade with leverage on all our CFD instruments**

24-hour trading (when the markets are open)

Trading platforms including MetaTrader 4 and TradingView

Global provider with 25 years’ experience

Popular indices

The French regulators introduced legislation at midnight on 18th March 2020 to prohibit short selling, as we do not know your exposure with other providers, the responsibility to ensure that you do not increase your net short position on the France 40 rests with you.

What are indices?

Indices (also known as stock indexes) represent the value of a group of assets or stocks listed on a particular exchange. Major financial indices include the Dow Jones Industrial Average, FTSE 100, CAC 40, and Dax 30. Different indices (or indexes) have their own criteria for determining constituent stocks.

The Dow Jones Index represents 30 large public-listed companies traded on the New York Stock Exchange weighted by price, whereas the FTSE 100 represents 100 of the largest blue-chip companies in the UK weighted by market capitalisation.

At OANDA, you can trade indices as a CFD. Our indices are derived from the price of the underlying instrument. We offer CFDs on most major global indices, including the UK 100, US Wall St 30, France 40 and Germany 30. When the price of stocks listed on an index rise, the price of the index goes up. When the price of stocks listed on an index go down, the value of the index falls along with it.

Ready to start trading? Open an account in minutes

Already have a live trading account? It's easy to fund your account using one of the following payment methods.

Pricing and liquidity providers

Our pricing engine aggregates live prices, in real time, from our liquidity providers and calculates a mid-point. A custom-built pricing algorithm automatically calculates the spread symmetrically around the mid-point for each tradable instrument. This mid-point fluctuates throughout the day as market prices change.

Execution

Our award-winning and customisable OANDA Trade platform is engineered for reliability and speed. This is especially important during periods of high volatility, when prices can move rapidly. Our platform can be accessed from your web browser.

Costs of trading

Fairness and transparency are at the heart of everything we do. At OANDA, we are upfront about our charges and fees, so you always know exactly how much you are paying when you trade with us. See our charges and fees page to learn about our costs for depositing and withdrawing funds, bank wire transfer, spreads, inactivity fees and more.

*Voted Most Popular Broker 2021 (TradingView Broker Awards 2021). Voted Best Forex and CFD Broker 2021 (TradingView Broker Awards 2021). Best Trading Tools winner (Online Personal Wealth Awards 2021).

**See our Margin Rates and Leverage Ratios for Retail Clients page for margin rates and leverage ratios offered to retail clients for each of our instruments.

See our Margin Rates and Leverage Ratios for Professional Clients page for margin rates and leverage ratios offered to professional clients for each of our instruments.

CFD trading

We offer CFD prices on a range of financial instruments, including indices, forex pairs, commodities, metals and bonds.

3 ways to trade, plus TradingView and MetaTrader 4

Access OANDA Trade from your web-browser, mobile and tablet, as well as TradingView and MetaTrader 4.

Powerful tools

Identify potential trading opportunities using the range of powerful analysis tools that are available on our trading platform.