Professional trading account

As a professional client, you can trade on a higher leverage level but will lose a certain level of protection.

Send us an email to know more about the professional account and a member of our team will contact you.

Eligibility criteria

To qualify, you must meet at least two of the criteria outlined below:

Trading history

You have placed at least 40 opening CFD or FX trades in the last year with a notional value of at least 50,000 (at least 10 opening trades with relevant volume per quarter in the last year).

Portfolio

You have an investment portfolio that exceeds €500,000.

Position

You have worked in the financial sector for at least one year in a professional position that requires knowledge of FX and CFD trading.

Features of an OANDA professional account

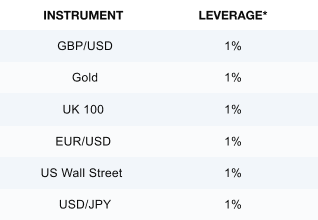

Margin rates for professional clients

Dedicated client relationship manager support

Our professional clients have access to a dedicated relationship manager. You will have their direct telephone number and email address. To find out more about the professional account, email us at:

As a professional account holder, you will be responsible for ensuring that your account does not fall into a negative balance. If it does, you will be expected to add deposits to cover the difference.

Range of platforms, including TradingView

As an OANDA account holder, you can speculate on the markets using our award-winning OANDA trading platform**, the globally recognised TradingView social platform or MetaTrader 4.

Frequently asked questions

What if I am not eligible to become a professional trader?

You can always apply to open a live account.

What are the main differences between the OANDA professional account and retail account?

Retail account clients have higher margin requirements than professional clients. However, retail clients have an increased level of protections compared to professional clients, which includes negative balance protection.

What client money protections will I lose as a professional trader?

ESMA (the European Securities and Market Authority) sets limits to the amount of leverage that a retail client may be exposed to on various CFD products. Professional clients are not affected by these rules and are therefore not provided by this protection.

Professional clients may lose the right of access to the OAFS (the Office of the Arbiter for Financial Services), which is available to retail clients unless they are an individual (professional client) trading in a personal ('consumer') capacity and not by way of business.

Fund segregation, as well as the investor compensation scheme, remain unchanged for both retail and professional customers.

What can be included in my ‘investment portfolio’?

Cash, stock portfolios, stocks, trading accounts and mutual funds, and SIPPs. Physical assets and managed company pensions are not accepted.

I have a status of professional client in another broker. How can I move my status of professional client to OANDA?

You cannot transfer your status from another broker. You will need to apply for professional client status at OANDA by contacting proenquiries@oanda.com.

Do you accept trading history from other brokers?

Yes. Trading history in the form of trading statements from other brokers will be considered for criteria 1.

*Leverage - Corresponds to:

100:1 - 1%, 50:1 - 2%, 40:1 - 2.5%, 30:1 - 3.3%, 20:1 - 5%, 10:1 - 10%

**Voted Most Popular Broker and Best Forex and CFD Broker 2020 (TradingView Broker Awards); Highest Mobile App Satisfaction and Third-Party Integrations (Investment Trends US FX Report 2020) and Overall User Satisfaction (Investment Trends US FX Report 2019).

CFD trading

We offer CFD prices on a range of financial instruments, including indices, forex pairs, commodities, metals and bonds.

Take a position with OANDA Trade

OANDA Trade can be accessed from your web-browser, tablet and mobile device.

Retail & professional spreads

Our spreads start from 0.8 points for the UK 100, 1 point for Germany 30, 0.6 for EUR/USD and 0.8 pips for EUR/GBP.